The special case: coke and coal in BEHG

Traders and users of coke & coal - The reporting and submission obligation in BEHG

Since 1 January 2023, solid fuels such as coke and coal have been covered by the Fuel Emissions Trading Act (BEHG), which means that responsible companies must surrender previously purchased certificates and report on their emissions. It is likely to be much more difficult for the responsible companies to identify which companies are affected by the reporting and surrender obligation than for the distributors of gas and oil, which have already been mandatorily in the national emissions trading system (nEHS) since 2021. In the case of solid fuels, the previous logic that the ETS obligation lies with the distributor without exception will be broken. For the first time in national emissions trading, not only distributors but also, under certain conditions, users of solid fuels will be subject to reporting and submission obligations.

Since 01.01.2021, distributors of fuels have been under a legal obligation under the BEHG - Fuel Emissions Trading Act - to purchase CO2 allowances in a number calculated on the basis of the quantity and respective CO2 carbon content of their fuels placed on the market. In the first two years 2021 and 2022, the BEHG regulated this only for gaseous and liquid fuels, such as gas, liquefied petroleum gas, petrol, diesel, etc.

Stage II of the BEHG has started as of 01.01.2023

In the second stage of the implementation of the BEHG - as planned for a long time - solid fuels and special oils have been included in the reporting and submission obligation since 01.01.2023.

More than 12 months before the start of stage II of the BEHG for the area of gaseous and liquid fuels, the vast majority of traders of the respective fuels were already asking themselves whether they were affected by the BEHG and whether they were subject to a reporting obligation and thus also to a duty of disclosure for their respective business model. Since a violation of the obligation is subject to fines and sanctions, those supposedly affected could study the BEHG of 12.12.2019 and its latest amendment of 09.11.2022 as well as guidelines and directives of the competent authority DEHSt or consult specialised law firms for a good fee. However, word quickly got around in the gas and mineral oil traders' industry that there was a rule of thumb, which was:

- Anyone who puts liquid and gaseous fuels into circulation is subject to BEHG if a monthly or annual energy tax return is submitted to the main customs office for one of these fuels, or even if certain tax reliefs from the energy tax obligation are available.

It was thus clear that the group of distributors subject to BEHG in Stage I of the BEHG consisted at least of the gas suppliers/municipal utilities, the liquefied gas traders and the mineral oil traders, e.g. with their own tax warehouse. Whether in individual cases, in addition to the reporting obligation, the purchase and surrender of certificates could be partially or completely omitted was then a secondary question. The main work was and is already the administrative obligation to maintain a monitoring plan and to prepare an annual report. This is where an affected company could and can make by far the most mistakes. The most frequent sanctions and associated administrative offences occur when a company becomes aware of its BEHG involvement too late.

Stage II of the BEHG - Which companies are obligated to participate in the nEHS?

According to the BEHG, the national emissions trading system (nEHS) provides that companies that place solid fuels, special oils as well as many other fuels on the market as of 01.01.2023 are now also subject to a reporting and submission obligation.

If one takes a closer look at the fuels of Stage II according to the Emission Reporting Ordinance 2030 (EBeV 2030) of 21.12.2022, one finds that the codes and subcodes of the combined nomenclature 2701, 2702 and 2704 to 2715 in particular are present in higher numbers for solid fuels. And it is precisely here that the problem arises which is apparently currently affecting large parts of this industry. It is the question:

Who in the coke & coal industry is subject to BEHG and who is not?

It can be said at the outset that there is no simple rule for the fuels coke & coal as there is for gas & oil. In addition, the question of the energy tax obligation - and consequently a BEHG obligation - only leads to a limited result. This is not only very unsatisfactory for the possibly affected companies, but also very dangerous. In case of doubt, the BEHG obligation will only be established ex officio by the German Emissions Trading Authority (DEHSt) 24 months after it has occurred or later. Then there is the threat of administrative offences and sanctions as well as high financial losses due to the additional purchase of CO2 certificates, which have become more expensive in the meantime. In addition, it is likely in this case that the CO2 costs were not included in the product calculation, which can put even financially well-endowed companies in dire straits.

What does the Level II obligation mean for companies in the BEHG?

In this respect, the question arises how in particular the estimated 800 -1,000 companies in Germany that buy, use and/or sell coke & coal want to determine whether they are subject to reporting or even levy under the BEHG since 01.01.2023. If the BEHG applies to the business model of the respective company, it should purchase allowances as soon as possible until December 2023 in order to avoid financial losses and submit a monitoring plan pursuant to Section 6 BEHG in conjunction with Section 3 EBeV 2030, which must be approved by DEHSt, as well as prepare an emissions report in May/June 2024 on the basis of the monitoring plan pursuant to Section 7 BEHG in conjunction with Section 4 et seq. EBeV 2030. The result of the report in tonnes of CO2 must then ideally correspond to the stock of national emission allowances (nEZ) with the previous year's identifier on the company's registry account as of 31.12. of the previous year or not deviate from it by more than 10%. Furthermore, the company should include the product-specific CO2 surcharges in the sales price of the end product as soon as possible.

Why are there exemptions from the energy tax obligation for coke & coal?

The energy tax law for coal has always differed significantly from other fuels. The reason is that Germany has always sourced oil & gas primarily from abroad, but has also sourced domestic coal from large and domestic deposits. In order to protect the domestic coal industry, coal was additionally promoted through "tax subsidies". This is still the case today in energy tax law, even though the German state has always wanted to get out of coal.

Determining the BEHG obligation via the legal regulations

In case of doubt, it is always possible for a coke & coal user or trader to establish 100% compliance with the BEHG obligation with the help of a legal advisor who has already dealt with the legal provisions of energy tax law and the BEHG. Since such a path can cost quite a bit of money and specialised lawyers are few and far between, the person potentially affected (also referred to as user or trader) will usually have to deal with the matter himself. According to the initial experience of those responsible, this is a laborious undertaking, which in some cases does not lead to 100% certainty as to whether a BEHG reporting and submission obligation exists.

If, on the other hand, a larger company is involved, the experienced in-house legal advisor will wriggle his way through the various provisions and references of the law and, after initial difficulties and the assumption of various scenarios, may arrive at more than one possible result, which is not really satisfactory either.

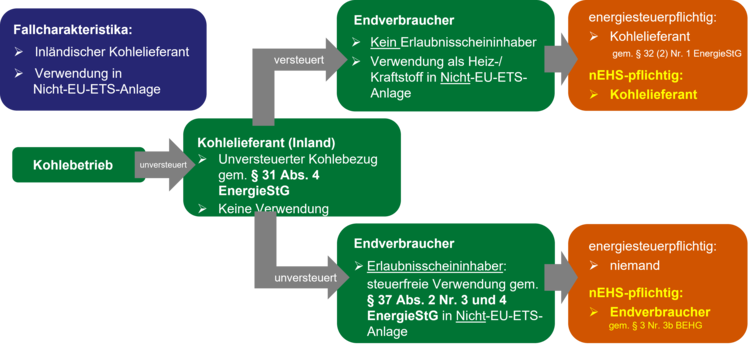

If, for example, one visualises one of his possible outcomes, it could look like the following.

In the above case, one of several scenarios of a coal supply chain has been played out. In the upper branch, the case first shows a coal supplier resident in Germany who is the holder of a permit pursuant to Section 31 (4) EnergieStG. The permit allows him to purchase coal from the coal company tax-free. The coal supplier then delivers the coal to the end consumer. If the end consumer purchases the coal taxed and uses it as heating/fuel in a plant that is not subject to EU emissions trading (EU-ETS), the coal supplier is obliged to pay the energy tax pursuant to section 32 (1) no. 1 and (2) no. 1 EnergieStG and is thus also subject to BEHG.

If, on the other hand, the end consumer has a permit to use the coal tax-free pursuant to Section 37 (2) Nos. 3 and 4 EnergieStG, as shown in the lower branch, and does so in a non-EU ETS plant, no energy tax is incurred in the entire coal supply chain for this coal share. However, although no energy tax is incurred, the end user as the holder of the permit is liable to pay BEHG pursuant to section 2(2) sentence 2 BEHG and section 3 no. 3b BEHG.

When considering the coal supply chain and assuming the variants of a taxed or untaxed sale by the trader, unsatisfactorily two different results emerge depending on the customer. Since different assumptions about domestic sourcing and the exclusion of use in an EU ETS installation must also be taken as a basis, the complexity of the analysis increases. This leads to uncertainty about the BEHG obligation for the observer.

This means that if a layman tries to determine a BEHG reporting and levy obligation on the basis of a tax consideration of the supply chain and the complex legal situation, he will not come to a certain conclusion in many cases. Above all, large parts of coke & coal users and traders will believe themselves to be in a deceptive state of security because they have erroneously come to the conclusion of a "non-BEHG obligation" in individual cases.

The energy tax obligation for coke & coal hardly leads to a result

The buyers, sellers and users of coke and coal who hold a permit for untaxed coal purchases pursuant to § 31 (4) and pay energy tax to their main customs office in Germany are probably in the minority. After all, as in Stage I for gas and oil, anyone who pays energy tax is liable to report and pay tax. The main reason for this is probably that if the company purchases coke and coal from abroad, it is subject to BEHG, as can also be seen in the BEHG decision tree under case no. 2. However, possible material uses can be taken into account in its calculations for deduction, as well as possible sales or forwarding of the coke & coal abroad.

Otherwise, however, it will currently be complex for companies that buy, sell and use coke and coal in Germany free of energy tax to identify an impending BEHG obligation in Stage II of the nEHS.

If no energy tax is incurred in a coke or coal supply chain, the connection between energy tax and BEHG obligation, which in principle existed for Tier I fuels under the BEHG, can be dropped. In the case of coal that is procured and used tax-free in accordance with § 37 (2) Nos. 3 & 4 EnergieStG, the BEHG obligation arises for the user. This means that if coke and coal are used in accordance with §37 (2) No. 3 & 4 EnergieStG, the user is obliged to report in accordance with §3 No. 3b BEHG and to surrender certificates.

The only exception to the above rule is the use of coke & coal in a TEHG installation, i.e. an installation in EU emissions trading. For these, there is a deduction entitlement for the corresponding quantity, which does not lead to a duty to surrender for the quantity of fuel to be verified in detail.

If exactly 100% of the coal is used in this TEHG facility, the BEHG obligation is completely waived for the holder of the permit pursuant to §37 (2) Nos. 3 & 4 Energy Tax Act. This is an exceptional regulation in the coal sector that does not apply to other fuels such as oil and gas.

The same applies,

- If coke or coal is used as a heating fuel or motor fuel with a permit in accordance with §31 (4) EnergieStG, the energy tax and consequently the BEHG obligation is incurred by the permit holder.

Basic rules and rules of thumb of the BEHG obligation

In order to provide companies that are buyers, sellers and users of coal & coke in Germany with the principles of a possible BEHG obligation, the following scenarios can be presented.

- Tax-free use in conjunction with a permit according to §37 (2) No. 3 & 4 EnergieStG, leads in most cases to a BEHG obligation.

- A 100% use of coke & coal in a TEHG plant after a previous tax-free purchase according to §37 (2) No. 3 & 4 EnergieStG does not lead to a 100% deduction and thus not - as one might think - to a BEHG obligation without surrendering certificates, but to a complete omission of the BEHG obligation. In short: If coke and coal are used 100% by a permit holder §37 (2) No. 3 & 4 EnergieStG in a TEHG plant, this is neither subject to reporting nor surrender.

- However, a tax-free purchase of coke & coal in a TEHG plant leads to a BEHG obligation as soon as only 1 t of CO2 is emitted in ancillary plants of the TEHG plant or the fuel is supplied to third parties subject to energy tax. Appropriate reporting is then required, which also leads to a duty to pay tax. For this reason, an internal clean quantity balance of the material flows (in/out) is recommended, as otherwise the differences lead to a BEHG obligation that is only discovered years later.

- A holder of a permit pursuant to §31 (4) who exclusively supplies coal traders who are also permit holders pursuant to §31 (4) and has no own consumption is not subject to BEHG. In our BEHG decision tree marked with no. 5. However, if the former uses part of the coal itself as heating and/or fuel, it is immediately subject to BEHG. In our BEHG decision tree marked with case no. 4. The holder of a permit pursuant to § 31 (4) is therefore treated in the same way as, for example, a tax warehouse holder for oil with regard to the BEHG obligation.

- There is a reporting obligation in the BEHG without a duty to surrender, i.e. a CO2 report with the result of zero tonnes of CO2 ("zero report"). Such a zero report may arise, for example, if the user of coke & coal is a holder of a permit pursuant to § 31 (4) and uses 100% of the fuel in his TEHG installation. See also case no. 4 in the BEHG decision tree.

- If a customer of a coal trader can show a permit pursuant to §37 (2) No. 3 & 4 EnergieStG or §31 (4) EnergieStG, the coke and coal trader is not subject to BEHG as a supplier for this quantity. Consequently, this means that if the trader is "lucky" enough to have all his customers in possession of a permit, then the coke and coal trader is not subject to BEHG. Conversely, however, this also means that if only one of the coke and coal trader's customers cannot produce a permit, then the supplier is under full BEHG obligation for the corresponding quantity.

Incidentally, the aforementioned point could mean in practice that if the trader had already recognised his "problem" in his customer structure in 2022 even before the start of the BEHG obligation in 2023, he could still quickly terminate the corresponding customer relationship. If he has not done so, he will first have to come to terms with the reporting and submission obligations regulated in the BEHG in 2023 and address this step in the current year in order to be able to leave the BEHG. However, he will of course still have to deal with the SESTA in 2024, as the reporting and certificate surrender for 2023 still have to be completed.

What does the BEHG obligation mean for affected companies?

Provided that your company has now been able to establish that it is affected by the BEHG, three resources are required as a matter of priority in order to fulfil the obligation: sufficient personnel capacities with the necessary know-how, liquid funds for the purchase of the certificates and, finally, well-documented, audit-proof business processes with regard to emissions reporting.

Liquid funds are often the most urgent problem for decision-makers, but in fact the easiest to solve. The funds can be generated by allocating the imputed CO2 surcharges to the product and thus to the customers with every sale. This should not be a disadvantage in a competitive comparison, since at least in Germany all competitors in the coke & coal industry have been directly or indirectly burdened by CO2 costs since 1 January 2023. Should there be competitive disadvantages in an international comparison, the company affected by the BEHG may be entitled to (partial) compensation from DEHSt.

The creation of audit-proof processes with regard to emissions reporting is somewhat more complex. Existing processes from accounting, sales and purchasing often serve as a basis here.

For the further development of these processes, affected companies then need the third and most difficult resource to acquire: the personnel capacities equipped with the necessary know-how.

In the case of larger companies that are already affected by the EU ETS, the know-how carriers are already at capacity. For many small and medium-sized enterprises, this is not yet available and often it is not economical to keep it on hand. Unfortunately, hiring new staff is not enough. Since tough compliance deadlines apply annually in national emissions trading as well, non-compliance with which can be punished with severe sanctions, at least one representative equipped with the same know-how is also needed. In order to be able to manage the registry accounts in a safe four-eyes principle in the case of representation, the two know-how holders would again have to be supplemented by one or two persons. Consequently, for the vast majority of companies, outsourcing CO2 reporting and register account management to a specialised service provider is the most economical and, from a risk perspective, also the safest solution.

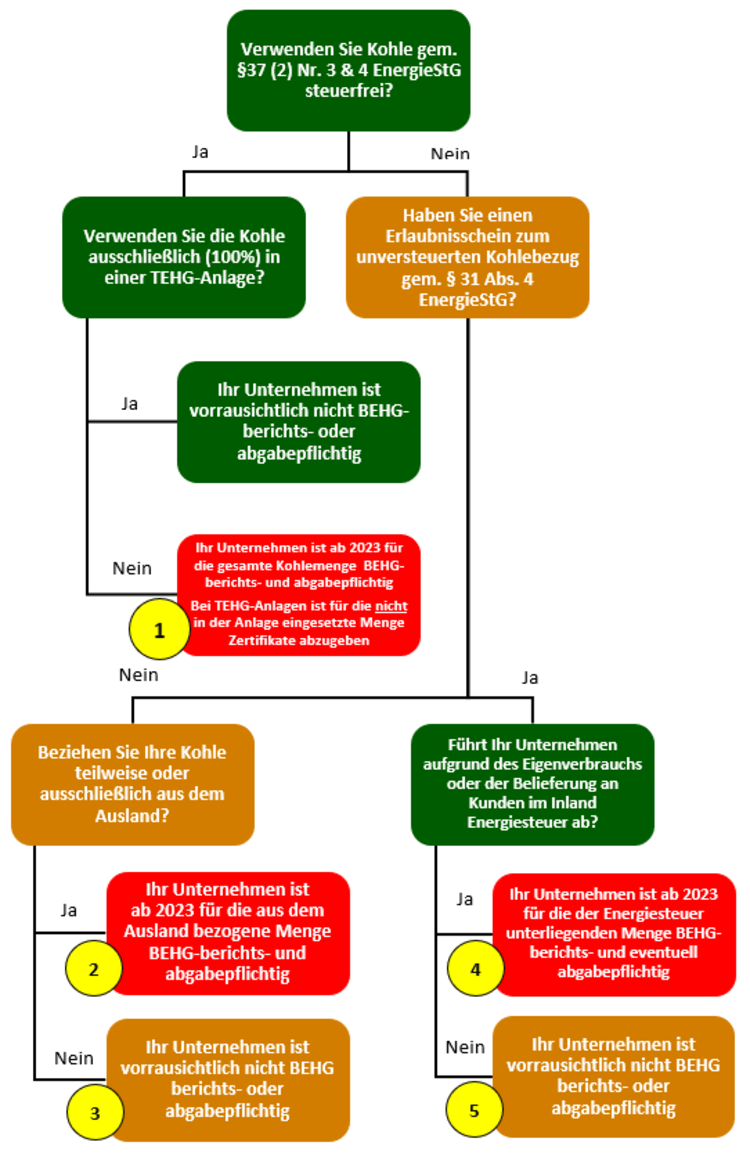

The Coal Decision Tree

The coal decision tree can be an information aid for traders active in the coke and coal industry, the corresponding producers as well as all types of coke and coal users as to whether they are subject to the BEHG obligation or not. The reporting and submission obligation is also illustrated in the following chapter "What is the conclusion for traders and users of coke & coal in terms of BEHG obligation?" using 5 different cases.

What is the conclusion for traders and users of coke & coal regarding the BEHG obligation?Traders and users of coke & coal should analyse their business model, their suppliers and especially their customer base as soon as possible in order to determine whether or not they are subject to the BEHG since 01.01.2023. In particular, they can escape the reporting and filing obligations of the BEHG if the trader ensures that all its customers have a permit pursuant to Section 31 (4) or pursuant to Section 37 (2) 3 & 4. To be reproduced in the BEHG decision tree by case no. 5.

Traders who do not purchase coal from abroad and at the same time do not have a permit pursuant to Section 31 (4) and traders who purchase coke and coal exclusively subject to energy tax are also not subject to BEHG. Graphically represented in the BEHG decision tree by the path up to case no. 3.

On the other hand, it can be said that users of coke & coal who have a permit pursuant to § 37 (2) No. 3 & 4 EnergieStG and do not burn their fuel in a TEHG facility of EU emissions trading (decision tree, case No. 1) have the most administrative work, because there are no energy tax declarations to fall back on with regard to quantity determination. This application of the BEHG is likely to affect the vast majority of coke & coal users in Germany.

In the case of this large majority of users, the various delivery notes and invoices must then be gathered from the accounting department in order to create a secure, verifiable quantity balance, which in the best case scenario should then result in a final and verifiable CO2 quantity with standardised emission factors.

Incidentally, this also means that this large group of BEHG obligated parties should attach particular importance to the legally required consistent, transparent, correct and, of course, timely emissions reporting, the cornerstone of which must be a monitoring plan approved by DEHSt before the end of 2023.

Companies that do not have the necessary expertise or are unable or unwilling to provide the necessary personnel should seek external expertise as soon as possible. Otherwise, affected companies will be threatened with administrative offences and sanctions. In addition, this leads to losses from CO2 surcharges that are not passed on or not included in the calculation and missing certificates, which can quickly add up to an extent that threatens the existence of the company concerned.